Looking backwards it seems relatively easy to spot the trend that pushed us towards mobile, with 3 strong drivers: a dramatic fall in communication costs, as well as in electronic storage costs and a large increase in computing power.

The combination of these three facts have transformed what were once common cell phones into computing powerhouses, with the firepower to run large applications and do things better than most computers did 5 years ago. Here's a quick chart showing the stage by stage evolution of the main computing eras of the last 50 years:

The appearance of tablets and e-readers, added to the already popular smartphones, has pushed this trend into main street faster than expected. The unexpected runaway success of the iPad has spurred innovation in the tablet terrain (which is part of the mobile world) and the fight between iOS and Android operating systems has reached an interesting stage, where neither claim victory yet each focus on different succcess factors to stretch their platform (iOS its ease of use, Android its free nature).

The amount of devices connected at this point is though to be in excess of 10 billion, 7 of which are feature and smartphones, then tablets and e-readers, and other connected devices (iPod Touch, wireless game consoles, etc.). The amazing thing at this point is not he current number but the rate of growth and expansion of this marketspace, paired with the strong competition among manufacturers and software platforms alike.

The fact that there are also relevant service providers fighting for the mobile space (Facebook, Amazon, square, Instagram, Pinterest, etc.) seems a relevant factor in determining the health and potential of the market. In a way, it is they that ignite the interest and generate more usage from clients, thus adding value overall to the mobile platform. In the value network, both developers and software houses play a critical role in feeding he network, without them the users would basically have nothing to do on the mobile internet.

All in all, it seems the tech wars include a major mobile component which cannot be disregarded. Although the mobile era seems in its infancy ... it might be getting to its teenage years faster than anyone would have thought, and Apple, Facebook, Amazon, Google and Microsoft certainly still have a word or two to say about it...

VERSUS: The fight for dominance and attention in the high-tech arena

Saturday, July 7, 2012

Monday, May 21, 2012

In 2012, Android confirms its leadership in Mobile Operating Systems (Mobile in Focus #2)

As in many high-tech markets, network effects apply very clearly in mobile operating systems. These effects usually result in a market tipping, that is to say, creating a competitive situation where winner takes all, leaving little space for strong contenders.

The winner before 2008 was clearly Nokia's Symbian, who was busy fending off upstart Apple, who took in 1 year a large chunk of its business. 2009 and 2010 were the years when Android spread like wildfire, reaching a share of 30-40% and becoming #1 mobile Operating System in terms of units. It is important to mention this (market share of units), because performance differs greatly when we look at market share of sales and profits (refer to this article). In 2011, Symbian bit the dust, BlackBerry and Windows ceded ground and the battle became a face-off between Apple iOS's integrated hardware and software platform versus Google Android's fragmented licensing approach.

For 2012 and later, estimates are a replay of 2011, with Android controlling over 50% of the shipments and iOS holding on to 25% approximately, and the rest far behind. Android seems to want to replay the battle that Microsoft fought and won over Apple in the desktop PC market 25 years ago in this new smartphone market. In that case, Microsoft's licensing approach was best fit to a model of explosive growth channeled through OEMs like HP, Compaq, Dell, etc., while in this case, the specifics of the network effects seem to be a bit different.

In the PC market, Apple was unable to generate indirect effects for developers and retailers with a share which shrunk below 5% of the units. With 25% of the units, in the market of smartphones, Apple seems to be in pretty good shape, generating a larger than proportional customer base (adding iPod and iPad users, and considering the iOS platform as one). Also, in terms of developer preference (here) and third-party sales (here), Apple is the big winner in the market. Therefore, it is able to maintain its position as a strong contender to Android, who is, by the way, suffering largely due to platform fragmentation, as seen here:

What is expected of the smartphone market? Analysts speculate that Android and iOS will coexist - maybe not so peacefully - while a new chapter of this fight is fought out in the tablet market ...

The winner before 2008 was clearly Nokia's Symbian, who was busy fending off upstart Apple, who took in 1 year a large chunk of its business. 2009 and 2010 were the years when Android spread like wildfire, reaching a share of 30-40% and becoming #1 mobile Operating System in terms of units. It is important to mention this (market share of units), because performance differs greatly when we look at market share of sales and profits (refer to this article). In 2011, Symbian bit the dust, BlackBerry and Windows ceded ground and the battle became a face-off between Apple iOS's integrated hardware and software platform versus Google Android's fragmented licensing approach.

For 2012 and later, estimates are a replay of 2011, with Android controlling over 50% of the shipments and iOS holding on to 25% approximately, and the rest far behind. Android seems to want to replay the battle that Microsoft fought and won over Apple in the desktop PC market 25 years ago in this new smartphone market. In that case, Microsoft's licensing approach was best fit to a model of explosive growth channeled through OEMs like HP, Compaq, Dell, etc., while in this case, the specifics of the network effects seem to be a bit different.

In the PC market, Apple was unable to generate indirect effects for developers and retailers with a share which shrunk below 5% of the units. With 25% of the units, in the market of smartphones, Apple seems to be in pretty good shape, generating a larger than proportional customer base (adding iPod and iPad users, and considering the iOS platform as one). Also, in terms of developer preference (here) and third-party sales (here), Apple is the big winner in the market. Therefore, it is able to maintain its position as a strong contender to Android, who is, by the way, suffering largely due to platform fragmentation, as seen here:

What is expected of the smartphone market? Analysts speculate that Android and iOS will coexist - maybe not so peacefully - while a new chapter of this fight is fought out in the tablet market ...

Labels:

Android,

Apple,

BlackBerry,

Google,

iOS,

Mobile,

Windows Phone

Sunday, May 20, 2012

2012 is the Year of Mobile Explosion (Mobile in Focus #1)

Last year, and for the first time ever, shipments of smartphones overtook shipments of PCs. As smartphones become more powerful and mimic most of the PCs processing capabilities, it should be an important fact. We are slowly migrating from a PC-centric world to a mobile world, embedded with "on-the-go" mobile broadband connections. It is relevant because it is the new place where the fight for high-tech dominance is taking place, and also because attention is so mucho more difficult to capture than it was 10 years ago in the PC era.

Mobile devices (smartphones, tablets and e-readers) hold roughly 70% of the shipment volume, according to market information from Gartner and IDC. If we consider that in 2005 we did not even know the term smartphone, it is truly a magnificent feat. As feature phones disappear and are replaced by smartphones, a world of new services becomes available to the user (via the apps sellers), a domain largely dominated by Apple and its iOS ecosystem with over 600 million active devices. Android, in spite of representing a large majority of these devices, has followed - as we will see in an upcoming Mobile in Focus post- a fragmented approach which might help it become the market leader in units but not in preference and overall quality.

So just how well are the big guys doing here? In a world dominated by mobile devices, the high-tech giants must strive to conquer this new landscape. Apple, in this case, sells the most successful and desired smartphone; Google provides the most widely used mobile Operating System (although it is not competing as a manufacturer, but rather as a licensor of the OS), Amazon is quickly adapting its applications to better suit the mobile world and has entered the hardware fight with its Kindle Fire tablet (based on Android OS), and Facebook is pushing to convert as soon as possible as many as possible of its users into mobile users of tools such as Facebook Messenger and Instagram, and it is rumored to be launching a branded phone soon ... the best is yet to come!

Labels:

Amazon,

Android,

Apple,

e-reader,

Facebook,

Facebook Messenger,

Gartner,

Google,

IDC,

Instagram,

iOS,

Kindle Fire,

Mobile,

PC,

smartphone,

tablet

Thursday, May 17, 2012

Are We in the Middle of a Social Media Bubble?

I feel this is going to be a tough sell for everybody. The two things I read most about are technology and social media, and it might be the combination of both that explain this phenomenon we are seeing in social media companies and their valuations. Are they sky-high? Compared to what? What we'll try to analyzed based on public information is whether there is some sense to this issue and try to figure out whether there really is a bubble or not.

Bubbles are determined mostly by irrational behavior and out-of-this-world prices. As far as irrational behavior, it totally depends what you put into that category ... Yahoo! used to trade at a 683x plus PE (Price Earning) ratio, meaning you'd actually have o wait more than 600 years at current returns to recover your investment. That sounds pretty unreasonable. Now, the companies we are talking about have users who do attract some forms of revenue - the most basic being advertising, but others mixing in some referral revenues and also freemium business models. There is no model wholly dependent on Fortune 500 companies buying an ad like it happened in 2001.

This is how we get to a landscape that looks as follows, in terms of users and valuations:

Most of our businesses, except for two (Facebook and Amazon) are stuck in the lower left quadrant, with less than 250 Mn users and valuations below $ 30 Bn. If you consider these excessive, then you might consider there is a bubble. Now, as reference, we are adding Amazon, a wholly e-commerce site, with a very large $ 100 Bn+ valuation and 160-170 Mn customers. Its valuation per customer exceeds by far any other company's (6 to 1 to Facebook), thus showing that a real business with real paying customers is, well, in another league. Facebook, in spite of its huge following, has a relatively low valuation per user and is the second outlier However, when viewed alongside Amazon, it seems somehow underachieving in terms of value per customer, which explains the doubts Wall Street has been showing recently on the company's monetization strategy. The other "reality check" is iTunes, with 250 Mn paying customers and a relatively low valuation (considered the revenue proportion of iTunes applied to the market cap of Apple).

Before concluding on the bubble issue, we must look at ARPU (Average Revenues per User). Now here the story gets murkier, since most of these companies are private and have yet to post revenue figures - but we can user the others to get some quick insights into how much a user is worth. Here's what we know:

What we and most of the companies in the lower left quadrant should be asking themselves is how to move laterally towards the right and join Amazon or ideally to the top right quadrant to fill that empty space. Until then, we have a flock of strong companies figuring out which business model really makes sense on the internet ...

If we consider both charts together, then it's easy to understand why there is so much talk of bubble. Who can justify a $ 1 Bn valuation for Instragram of $ 1.5 Bn valuation for Pinterest when their predecessors Zynga, Groupon and LinkedIN are having a hard time reaching that amount of revenues. Facebook, for all its might, shows a very low monetization of less than $ 5 dollars per user per year, both from advertising and from commissions on gaming, etc. How many users do Pinterest and Instagram need, and at what level of monetization using what business model to validate the large valuations?

Until the more established companies are able to show more success in these ventures - without considering Amazon and iTunes, 2 very successful models - there will inevitably be talk of social media bubbles and crazy valuations ...

Bubbles are determined mostly by irrational behavior and out-of-this-world prices. As far as irrational behavior, it totally depends what you put into that category ... Yahoo! used to trade at a 683x plus PE (Price Earning) ratio, meaning you'd actually have o wait more than 600 years at current returns to recover your investment. That sounds pretty unreasonable. Now, the companies we are talking about have users who do attract some forms of revenue - the most basic being advertising, but others mixing in some referral revenues and also freemium business models. There is no model wholly dependent on Fortune 500 companies buying an ad like it happened in 2001.

This is how we get to a landscape that looks as follows, in terms of users and valuations:

|

| Users and Market Values |

Before concluding on the bubble issue, we must look at ARPU (Average Revenues per User). Now here the story gets murkier, since most of these companies are private and have yet to post revenue figures - but we can user the others to get some quick insights into how much a user is worth. Here's what we know:

|

| Users and Annual Revenues |

If we consider both charts together, then it's easy to understand why there is so much talk of bubble. Who can justify a $ 1 Bn valuation for Instragram of $ 1.5 Bn valuation for Pinterest when their predecessors Zynga, Groupon and LinkedIN are having a hard time reaching that amount of revenues. Facebook, for all its might, shows a very low monetization of less than $ 5 dollars per user per year, both from advertising and from commissions on gaming, etc. How many users do Pinterest and Instagram need, and at what level of monetization using what business model to validate the large valuations?

Until the more established companies are able to show more success in these ventures - without considering Amazon and iTunes, 2 very successful models - there will inevitably be talk of social media bubbles and crazy valuations ...

Monday, May 14, 2012

iOS: Racing towards 1Bn devices

The tech wars for our attention - and our pockets - have silently begun without our noticing it. Companies have different strategies based on their relative strengths and overall intent. Microsoft, for instance, has realized that PCs have become largely commoditized and "corporate" and is aiming to take over our living room using the XBox360, which has sold some 65-75 Mn devices. Google has chosen to licence its Android OS, in a clear attempt to copy the strategy followed by Microsoft with Windows, and while Amazon aims to sell truly anything, Facebook is going silly trying to be the portal to our lives.

Apple has taken the consumer by storm, invading our lives with over 629 million devices since the launch of its first iPod. These iOS devices looked innocent at first; a nice MP3 player, a nice phone, etc., but after the iPad's launch it is clear there is no innocence but a crude intent to build an ecosystem fueled by iTunes and its almighty selling powers to take over our lives. iTunes has sold over 15 billion songs and 25 billion applications at a rate of 24 songs and 40 applications per device, and the iOS cumulative revenue can be estimated north of U$S 250 billion.

The really interesting part is that each new iDevice has outperformed its predecessor - the iPhone, 20 quarters after launch, has sold 3.2x more devices than the iPod. This means people are more educated on the gadgets and accept them faster. The iPad, a large bet since Apple was the first-mover in this space, has so far (8 quarters after launch) sold 3.2x more devices than the iPhone and 51x more than the iPod.

At whichever rate the tech wars continue, the iOS installed base continues growing rapidly and the positive feedback loop is already under full steam, generative direct and indirect network effects for users, developers and manufacturers of complementary iOS products. Competitors will have to find a way for users to trade in their devices - all 600 million + of them - for their own, and win their trust to sell them content and applications. If someone is up for it, it seems, in the best case, it will take many years to accomplish ... Steve Job's legacy is, for now, well guarded.

Apple has taken the consumer by storm, invading our lives with over 629 million devices since the launch of its first iPod. These iOS devices looked innocent at first; a nice MP3 player, a nice phone, etc., but after the iPad's launch it is clear there is no innocence but a crude intent to build an ecosystem fueled by iTunes and its almighty selling powers to take over our lives. iTunes has sold over 15 billion songs and 25 billion applications at a rate of 24 songs and 40 applications per device, and the iOS cumulative revenue can be estimated north of U$S 250 billion.

The really interesting part is that each new iDevice has outperformed its predecessor - the iPhone, 20 quarters after launch, has sold 3.2x more devices than the iPod. This means people are more educated on the gadgets and accept them faster. The iPad, a large bet since Apple was the first-mover in this space, has so far (8 quarters after launch) sold 3.2x more devices than the iPhone and 51x more than the iPod.

At whichever rate the tech wars continue, the iOS installed base continues growing rapidly and the positive feedback loop is already under full steam, generative direct and indirect network effects for users, developers and manufacturers of complementary iOS products. Competitors will have to find a way for users to trade in their devices - all 600 million + of them - for their own, and win their trust to sell them content and applications. If someone is up for it, it seems, in the best case, it will take many years to accomplish ... Steve Job's legacy is, for now, well guarded.

Labels:

Amazon,

Android,

Apple,

Facebook,

Google,

Growth,

iOS,

iPad,

iPhone,

iPod,

Microsoft,

network effects,

positive feedback loop,

users,

Windows,

XBox360

Sunday, May 6, 2012

Is Facebook ready for its IPO? or Too Late?

As Facebook prepares its final run into its IPO (the company is looking at a 90-100 Bn dollar valuation at a $28-$35 value per share), the prospectus let us into some of their very interesting and well-kept numbers. Inevitably their impact is two-fold: first, we can understand more on the social-media powerhouse, but secondly, we can also see where it's having growth pains. The most relevant information therein contained is here:

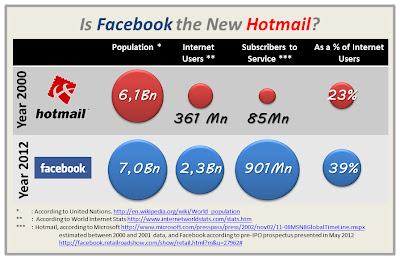

The fact alone that Facebook is near 1 Bn users is astounding. However, things must be seen in contrast: I have repeatedly heard "Facebook is the new Hotmail", in comparison with Microsoft's popular webmail service. The comment comes from the fact that Hotmail was the standard way for content (video links, jokes, pictures, etc.) to be shared in the late 90s and early 00s), and most of this is now done on Facebook. So, I conducted my very quick figure comparison:

If we trust these quick numbers, then the answer is NO; Facebook appears to be larger in terms of penetration of internet users in 2012 than Hotmail was in 2000 (39% vs 23%). What could be argued is that what should be taken into account are active daily users, however, that information is not readily available for Hotmail in 2000. If we compared Facebook's current daily active users - 58% of total or some 526 million, and assuming all of Hotmail users in 2000 connected daily, then it would be a technical tie at 23%. The longer answer is then MAYBE, JUST MAYBE, Facebok is the new Hotmail. If it is, then it must also be aware that it might be as safe as the T-Rex in the late Cretaceous period ... IPO or not.

The fact alone that Facebook is near 1 Bn users is astounding. However, things must be seen in contrast: I have repeatedly heard "Facebook is the new Hotmail", in comparison with Microsoft's popular webmail service. The comment comes from the fact that Hotmail was the standard way for content (video links, jokes, pictures, etc.) to be shared in the late 90s and early 00s), and most of this is now done on Facebook. So, I conducted my very quick figure comparison:

Saturday, May 5, 2012

High-Tech Companies and Stock Performance

It's becoming very common to speak wonders of a company because of its short-term stock performance. If you are looking for a quick buck, the approach might be right. However, if you want to understand longer term viability for the business, you need to look at trends. Below is a figure with selected companies - the ones involved in the fight for your attention and your tech spending - and their stock performance for the last 10, 5 and 1 year - and 2012 year to date performance:

Some quite interesting trends can be quickly spotted using the stock performance in colors and relative sizes:

- 10 years: Apple is the big winner, and Microsoft the biggest loser. This appears to support the boom in consumer electronics (fueled 10 years ago by the iPod) and Microsoft's stagnation after its antitrust suit.

- 5 years: Same as 10 years, Apple with largest returns and Yahoo! falling by over 50%. This confirms the demise of the portal business as a viable content aggregation venue. Microsoft shows a 1% performance, barely in positive ground.

- 1 year: Apple still on top, fueled by its iOS triad (iPhone, iPad, iPod), and worst in class is still Yahoo!, this time followed by Google, so far showing many doubts in its Android strategy to compete against Apple's products.

- Year-to-Date: Apple remains on top, while Google is the worst in class. While the post-Steve-Jobs Apple has managed to snatch the role as most valuable company in the world, Larry Page's Google is flat in search growth (and still very much a one-trick-pony, largely dependent on advertising as a source of revenue) and still muddling through its tablet and smartphone strategy.

Subscribe to:

Posts (Atom)